The Bizarre World of Non-Fungible Tokens

Published 2021-03-01

The Bizarre World of Non-Fungible Tokens

If you've been in the online tech space at all in the past week or two, you know the big hubbub everyone's yapping about are "NFTs", or "non-fungible tokens". As opposed to fungible tokens like Bitcoin that aren't unique, every NFT represents a very specific object. There's a lot of uses of NFTs popping up, being the next big blockchain innovation. Let's look at what's going on with the NFT craze, and investigate the issues that NFTs have.

A Short History of Crypto and NFTs

Bitcoin is a "cryptocurrency", a sort of digital fungible token that can be used for economic transactions. Being decentralized and anonymous (with caveats), it uses a "blockchain" replicated across many different computers (known as "nodes") to keep track and verify the transactions in a write-only, cryptographically secure way. One very important aspect of the Bitcoin network is preventing what's known as a "51% attack". If 51% or more of all nodes in the system are controlled by one group, they have control over every single transaction that occurs on the network, effectively killing off the currency.

To solve the 51% attack problem, there needs to be a way to limit the number of nodes on the system. Bitcoin uses a "proof of work" system. Mining is a complicated subject I don't feel qualified to get into, but essentially, the more processing power you throw at the network securing hashes, the greater chance you have at successfully creating a "block" of Bitcoin and claiming ownership over it. It's very important to note that the "mining" process is artificially difficult to keep blocks generated at a constant rate of one every 10 minutes.

This proof of work system leads to a zero-sum game where everyone wants to have the highest chance at mining a block, so they keep throwing more and more processing power at the network. Think of it something like the arms race between the US and the USSR in the Cold War. Nothing new is being gained, but you need to make sure you don't lose your foothold. With Bitcoin, this started with simply using idle CPU cycles, then GPU time, then FPGAs, then dedicated silicon (ASICs), and so on and so forth. This has, among other things, led to the Bitcoin network consuming more electricity than the entire country of Argentina and massively contributing to GPU shortages and carbon dioxide emissions. (Current power estimates for Bitcoin clock in at 77 TWh/year.)

An early example at an attempt of non-fungible tokens on a blockchain was Namecoin. Namecoin was designed to register domain names on the ".bit" TLD, each registration record costing 0.01 NMC and lasting for about 200 days. It reuses most of the technology (and, for a while, the same blockchain) as Bitcoin, so it inherits all that baggage such as the 21 million coin limit and the proof of work system.

Besides that, there is also Filecoin, which allows for the rental of unused hard drive space from others. This, interestingly, works via a "proof of space", where instead of requiring every node to have an arms race of processing power, it requires an arms race of storage space. This is actually well suited for Filecoin, whose express purpose is to store files on the blockchain. Plus, storage on standby consumes significantly less energy than GPUs, ASICs, and FPGAs on full blast.

The most popular blockchain for NFTs, though, is Ethereum. Ethereum is special because instead of using the data-record systems that Namecoin and Filecoin do, it uses "smart contracts". Smart contracts, according to Ethereum's website, are something like "Ethereum bots". They appear as accounts that you can interact with via spending ETH, that perform certain actions that effect the state of the bot, such as record keeping or producing a unique, non-fungible token that can be sold back later. Smart contracts are compiled for the "Ethereum Virtual Machine" and executed directly on the blockchain itself. How exactly that works is rather complicated and outside the scope of this article.

The important thing to note is that Ethereum is also a proof of work system. Every single smart contract deployed or executed, every single NFT generated or transferred or sold, consumes astronomical amounts of electricity. There are efforts to move Ethereum to a proof-of-stake system instead, but this is far off in the future still. (Proof of stake merely requires "staking" coins, giving them up as collateral for permission to validate blocks.) This means that many of the NFT applications showcased here are consuming thousands of kilowatts of electricity per transaction. You can view exactly how much for a given address here, if you're curious. Keep that in mind as we move forwards.

If you take one thing away from this article, it should be that all proof of work systems including Bitcoin, Ethereum, and anything backed by them, are devastating for the environment and must be discarded for a more favorable alternative.

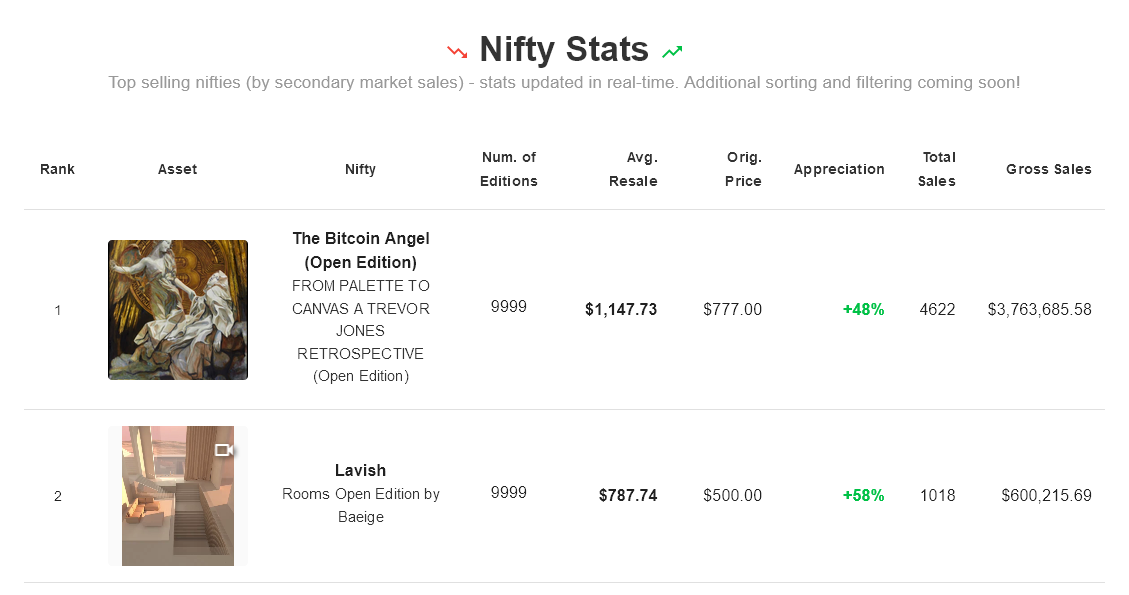

Crypto Art

This is the hottest and most famous usage of NFTs right now, and also the most criticized. The very short version is that crypto art marketplaces, such as Nifty Gateway, SuperRare, and MakersPlace allow for the sale of "ownership" of digital artwork through the use of smart contracts.

When an artists "mints" artwork on a marketplace, a NFT will be created representing ownership of that image. (This is one transaction on the ETH network.) When the artwork is sold, the buyer exchanges some amount of money (in ETH) for ownership of the NFT. This money will go to the artists with a cut taken by the marketplace. (For MakersPlace, this is a 15% cut.) If the artwork NFT is sold from one person to another, a transaction takes place where the artist receives some royalty (10% on MakersPlace) and the seller receives the remainder. All transactions are permanently and publicly recorded in the Ethereum blockchain in a cryptographically secure manner, and all transactions are enforced via smart contracts.

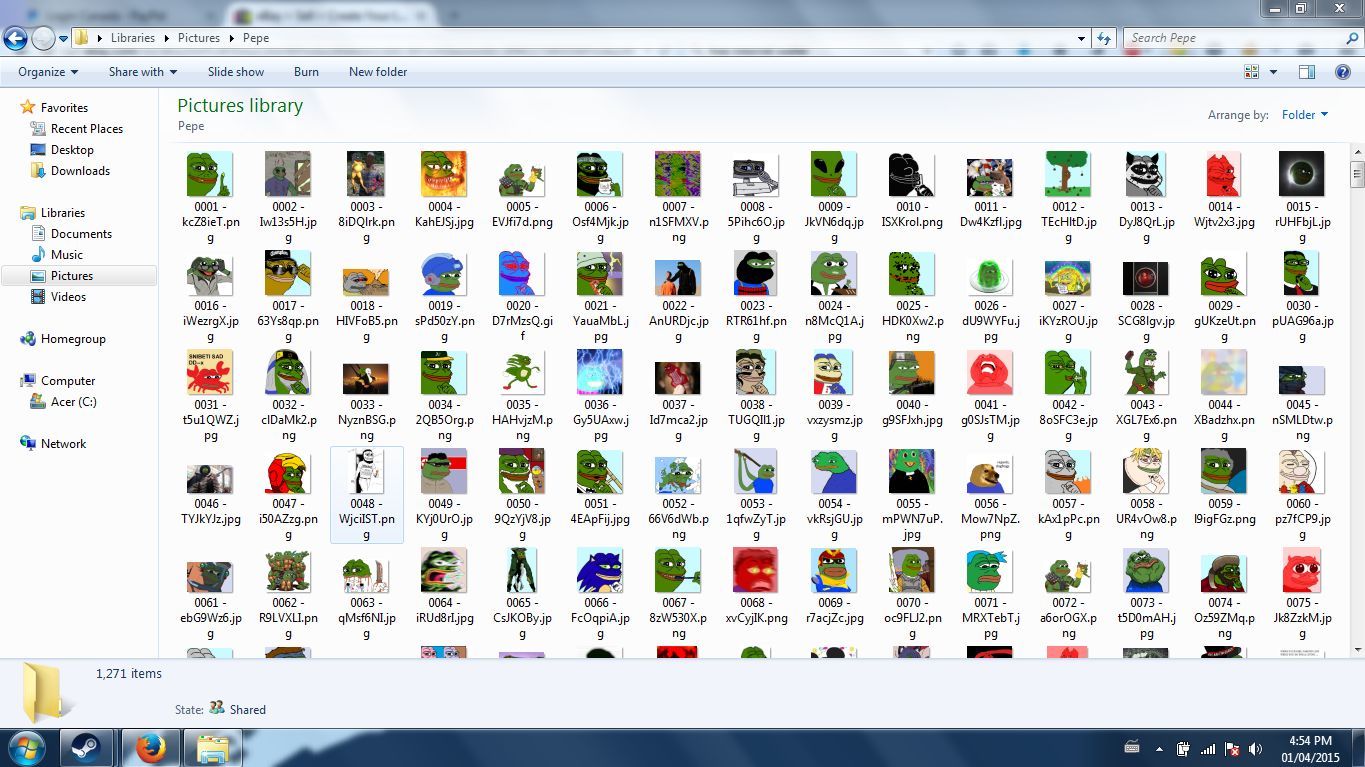

Believe it or not, there is a precedent to this. In 2014, before Pepe the Frog became the defacto mascot of the alt-right, a common 4chan meme was to collect "rare Pepes". The Pepe memes, including one posted by Katy Perry, were seen as an attack on 4chan's beloved Pepe, a sign that he had been co-opted by the "normies". As a response, there were "rare Pepes" circulated that were to be seen, not downloaded. The memes' "rarity", and thus their value, was dictated by how often they were reposted. There was a certain balance between having your Pepe be seen, but not fall into the hands of the "normies", a certain level of artificial scarcity to hit.

That was all fun and games until people actually started selling their collections of rare Pepes on online auction websites like Craigslist and eBay. Not many of them sold, but it was still an interesting development in the idea of otherwise meaningless digital objects having value because of their artificial scarcity. Later, several Pepe trading websites built on Counterparty (smart contracts on the Bitcoin network) sprung up, and some individual Pepes sold for thousands of dollars.

You might note that the ownership of digital art is a very weird concept. Digital art is, at the end of the day, just a collection of bits and bytes. A JPEG file, maybe a PNG or TIFF if you're feeling fancy. Essentially, what you're paying for are bragging rights, the ability to say "I own unique copy X of artwork Y". These bragging rights may or may not be worth more in the future, prompting buyers to speculatively buy and artists to say "oh crap, free money" and sell artwork on the exchange. That last bit is important because digital artists generally have a very difficult time monetizing their artwork apart from offering commissions or maybe prints.

This would be a really neat (if pointless, from a practicality standpoint) if it weren't for the energy costs involved. I would explain that here, but I don't feel qualified to do so, so instead I'll defer you to "The Unreasonable Cost of #CryptoArt", a great blog post on the subject. There is also a calculator, cryptoart.wtf, which as of writing is currently down due to being overloaded.

Crypto Land

Real estate is always popular to get into IRL. Buy some land in a promising location, wait a bit, sell it later. Land costs almost always go up, so this is a win-win for everyone involved. (Well, except anyone who actually needs the land to live on, and is forced to pay upwards of a thousand dollars a month in rent, but who cares about them. /s)

But real land is popular, involves a lot of paperwork and responsibilities, and is a very slow process. What if we had virtual estate? ...no, not like SimCity, something with real, blockchain-backed assets. I've found two competing apps that promise to let you do exactly that.

Upland

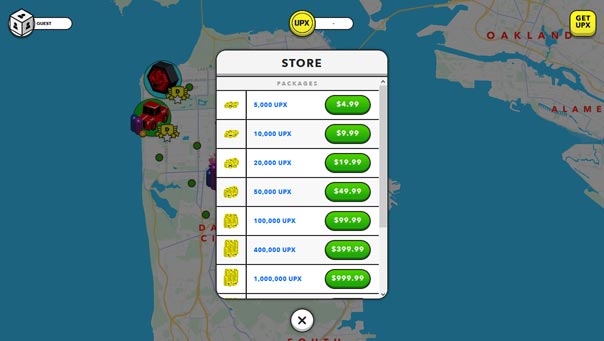

First, we'll look at Upland, which claims to be "Earth’s Metaverse where you buy, sell, and trade virtual properties mapped to the Real World." The best way I can describe it is that it's Monopoly with real money. It runs on the EOS blockchain, a competitor to Ethereum that does use Proof-of-Stake. Specifically, it uses "delegated proof of stake", which allows stakeholders to vote on network decisions. So, good on you for not being an ecological disaster. That said, I'm still going to clown on this because the concept is a bit silly.

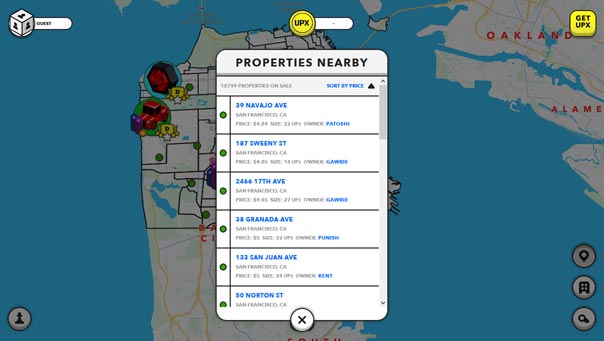

Upland runs on its own virtual currency known as "UPX". With UPX, you can purchase properties. Right now, the only two areas are the Bay Area and New York City. (This makes sense, as those are the two cities with the highest concentration of rich tech workers/entrepreneurs.) You'll notice, in this screen that looks just like any other mobile game, that you can purchase absurd quantities of coin in a single press. The highest value for sale is 25 million UPX, or $25,000 of virtual currency. It is also very important to note that at the moment you cannot withdraw money, although Upland is partnering with the financial division of the creators of Second Life to add this feature "soon". (Sure...)

With your recently acquired UPX, you can buy a property! Your minimum lot price seems to range from $5-$10, although there is plenty being sold for millions of UPX. (In the screenshot these prices are listed in dollars, but I just went back to check and in the last few days they're using UPX now, so that's odd.) You might note that millions of UPX is thousands of real-world dollars. This is actually representative of the amount of money being thrown around. Just four days ago, the virtual Grand Central Terminal was sold for $21,000. $21,000 would be a life-changing amount of money for me, and it was spent on a very risky investment of virtual land. Yes, I am salty.

Last thing I'll bother pointing out is that much like Monopoly, you are incentivized to own properties fitting certain "collections", like "three in the Sunset neighborhood of San Francisco". There's also "challenges", which are like collections but time-limited. Completing a collection gives you a one-time UPX reward and a boost to your rent. Yes, rent, let me explain how that works.

You can't just click on a property to buy it. You have to walk to it. You can't control the direction your "explorer" walks in either; you either have to let it wander around randomly, use a "send" (you get 3 a day, plus you can pick up more by wandering around) to a known property, or pay a "visitation fee" to a known property. As I said, this is literally just virtual Monopoly with real cash.

The challenges, along with "treasure hunts" and other live events, encourage "Uplanders" to keep coming back and engaging, stimulating the economy of virtual land in all perpetuity. It's a neat idea, but the mind-boggling amount of cash at play along with the current inability to withdraw worries me a bit. I will also take this moment to be a cynic and point out that the entire purpose of Monopoly, when it was designed as "The Landlord's Game" in 1903, is to point out that this sort of speculative land investment would always favor one winner, leaving anyone impoverished unable to compete in the marketplace. In summary, beyond being a weird investment vehicle that's mildly entertaining, there isn't much to this. There is an alternative, though.

Decentraland

Decentraland is a virtual reality world that oozes an anarcho-capitalist moxie. You control a virtual avatar, you can buy plots of land surrounding themed "district" areas, and you can chat with people. It's a lot less interesting than Second Life, there's a lot less to do, but you can buy and sell land, wearables, and usernames on the blockchain. (Having a marketplace for usernames in particular is an oddly bold move, but I guess their assumption was that people were going to do that anyways.)

The blockchain used here is Aragon, yet another Ethereum competitor. I am having a difficult time determining whether this uses proof-of-work or proof-of-stake. This 2019 blog post claims that Aragon runs on Ethereum, but an alternative blockchain built on Polkadot (which allows for cross-blockchain transfers) is in an early research phase. A later 2020 blog post states that this alternative blockchain is being sunset, and that they are considering switching to Ethermint, which is a "scalable, high-throughput Proof-of-Stake blockchain that is fully compatible and interoperable with Ethereum." For now, I'm assuming that Aragon is something that utilizes Ethereum and it's Proof-of-Work baggage, meaning that all transactions here incur absurd electricity and environmental costs.

Oh, yes, and let's talk about the "decentra" in "Decentraland". They attempt to explain it here, but it's all buzzword soup to me. From what I can gather, thanks to being built on Aragon, which allows for the creation of a "decentralized autonomous organization". The official explanation is almost impossible to get any meaning from, but as far as I can tell a DAO is an "internet-native entity" with no central management that executes rules codified on the blockchain as smart contracts, allowing for the community to operate in perpetuity with group decision making via votes. DAOs are proposed as alternatives to traditional companies by being loose, global, and transparent. It is worth mentioning that workers cooperatives already exist, but I suppose that's beside the point.

We can ignore all that and say that Decentraland is "decentralized" because policy decisions have to be voted on by the community. Except, actually, it's not. There exists a "Security Advisory Board" of 5 people who have the exclusive authority (after unanimous consent from the 5) to replace smart contracts and create ballots to be voted on. The ballots they create include proposals to replace a member of the SAB. Also, votes have "power" following a sort of proof-of-stake system, where the more assets you own, the more power you have. If you ask me this does not feel like an anarchist, decentralized system, but instead one controlled by a small oligarchy. Also, the other things the members vote on (setting fees, scheduling auctions, adding content servers) feel like internal technical things that really shouldn't be up for vote. The kinds of things that, IRL, we let politicians and representatives worry about.

The whole vibe I'm getting from Decentraland is that it is incredibly confusing to work with. Just looking at the instructions for voting on proposals or making an account is making my head spin. I just don't see what this brings to the table compared to a non-blockchain alternative such as Second Life. Second Life doesn't need a blockchain backing it, as it instead has the legal backing of a corporation instead that can handle monetary transactions and grapple with the legal system. Second Life is also just a much more entertaining and interesting game, in my opinion. I suppose the one good thing is that Decentraland is open source, so that's good at least. Their whitepaper is an interesting read as well.

Crypto Pets

As a kid, I grew up on a healthy dose of Sonic Adventure 2. In that game is the "Chao Garden", an area where you raised virtual pets known as Chao. The Chao system actually had a lot of depth to it, with lots of minigames, purchasable items, genetic inheritance, and other such things that would allow you to fine-tune and optimize your Chao to be better and better. Here's a whole dang wiki on the whole Chao system if you're interested.

So imagine doing that, but then selling the Chao for a profit. That's basically what people are actually doing.

CryptoKitties

CryptoKitties is the first popular "crypto pet" application. And by popular I mean popular. It not only congested the entire Ethereum network, but also had individual kittens selling for $140,000, celebrity endorsements, and a variety of copycats including EtherTulips, Ethermon, and Aavegotchi.

The main draw here is that you have kittens, and you breed them to create new kittens. By trading and breeding kittens, you can create the genetically perfect cat collection you've always desired. Trading and breeding requires some amount of Ethereum, which CryptoKitties takes a 3.75% cut from (according to the whitepaper). The documentation specifically advises that "this is a game centered around collecting digital cats, not an investment portfolio or a get-rich-quick opportunity." and that "You might make some money, but don't be annoyed if you don't. Just love your cats.", which is a good way to look at it. Breeding is more or less free (minus network transaction costs), so you can still enjoy the game to some extent without putting much in.

I would have little ill will against this, except for the fact it uses Ethereum, which again, is proof-of-work. I sound like a broken record, but every virtual kitten you create makes a kitten in the real world very very sad.

Axie Infinity

Axie Infinity, according to its whitepaper, is a Pokémon-inspired universe where anyone can earn tokens through skilled gameplay and contributions to the ecosystem. Players can battle, collect, raise, and build a land-based kingdom for their pets. It (supposedly) has surpassed CryptoKitties to become the most popular Ethereum game, generating over $2,000,000 in revenue.

There appears to be three game modes. The first is a virtual pet collector and breeder much like CryptoKitties, complete with a similar genetics system. Unlike CryptoKitties where breeding costs only 0.008 ETH (about $11.58 as of writing), breeding in Axie Infinity costs 0.05 ETH, or about $72.37. I don't know how anyone is supposed to afford this.

The second game mode is a battle system, where groups of 3 Axies battle in a turn-based card system. There seems to be a decent amount of strategy involved. Read more here if you're interested..

The third game mode is "Land", where you, an Axie owner, purchase and decorate plots of land in Lunacia (the Axie homeland). Resources periodically spawn on the map that can be used for building or upgrading Axies. In addition, there's monsters known as "Chimera" roaming than can be attacked and defeated for additional goodies. There are 17,241 plots of player-owned land, and that's all there will ever be. This mode is currently incomplete.

Now, clearly, there is an incredible amount of charm to the world made here. The art is nothing short of fantastic, and the gameplay looks like it would be decently fun for what it is. My issue is that it seems like everything is nickel-and-dimed to hell and back. This is as bad as some of the worst mobile games when it comes to how much money you could pour into this. Right on the front page it boasts that the most expensive Axie sold was for 300 ETH, which as of writing, is over $430,000. For a virtual pet. I genuinely cannot fathom why anyone would pay that much. I could almost retire on that money, at least for a few years. And, yeah, being backed on Ethereum, we still run into that pesky climate problem.

Some Personal Thoughts

I could keep going on, as it really seems like everything that could be monetized has become monetized. But I think you get the picture. If this is the future, I cynically oppose it.

Proof-of-stake systems do massively reduce the ecological cost of the blockchain but don't really resolve the fact that blockchain-backed applications as they are now are (likely) an obvious bubble waiting to pop. You'll see shortly that almost every NFT application is built around speculative investment, buying low and hoping to sell high. Uncountable numbers of tech companies are competing to get in on the ground floor of this craze and be the vehicle for people's investments. Over time, I suspect that this market will be oversaturated and the returns from NFT investments that aren't just raw cryptocurrency will be less than just throwing money into a mutual fund, just due to the demand being so spread out. I will also admit that I have no proof for any of this, but that's just my gut feeling on the matter.

Smart contracts and NFTs have their merits, though. I like the concept of a distributed network of transactions that's public accessible, write-only, and cryptographically secure. It prevents assets from being lost or stolen in the event of a server breach. It's impossible to change the code behind a smart contract, and it's always publicly auditable. I can see lots of potential in this if the network wasn't environmentally destructive.

But it only makes sense to go through the trouble of this level of security if the assets in question are actually valuable. Smart contracts are inherently designed to give digital items value by giving them artificial scarcity, to back that value via a cryptocurrency, and to enforce it via cryptographic guarantees. In contrast, for standard legal contracts regarding physical property, that value is given by physically existing and being useful and wanted and actually scarce, backed by the US dollar (or your applicable local currency), and enforced by law enforcement, lawsuits, and the entire legal system.

I really do not like this trend of creating emotionally manipulative artificial scarcity in the form of virtual land, cool art, or cute monsters that you and only you can own. If you want cool art or a cute monster, commission an artist instead. Then you'd get something that's actually a unique work of art, and without destroying the environment either.

Here's hoping that we can fix the ecological nightmare of the blockchain and figure out better ways to allow creative minds to receive the payment they deserve, because NFTs just ain't it.