My Bitcoin Adventure (April Fool's 2021)

Published 2021-04-01

This was hastily written for April Fool's 2021, where Viz was playing the role of the Vizler, a crypto-obsessed capitalist. Take that into perspective as you read this.

This single silly Reddit ad is responsible for my early involvement in the greatest revolution in finance the world has ever seen. What seemed like some simple "magic internet money" has turned absolute dividends for me, thanks to the power of unrestricted free market capitalism. Let's look at exactly how that happened.

I was browsing Reddit one day around 2013 or so, saw that ad, and got entranced into the world of magic internet money. I was seriously invested in it (emotionally, not so much financially, due to the fact I was 14 at the time). Here's, roughly, what the subreddit would have looked like at the time.

At the time, the biggest use case for Bitcoin was buying drugs on the Silk Road, followed by other unregulated shops, and of course most famously as an investment vehicle. The entire point of Bitcoin, as I understood it, was that it was entirely free from government restriction due to being anonymous. And, if you did your civic duty to keep the network secure by using your PC's spare computational power for "mining", you'd get paid for doing so. It's nice, decentralized, democratic, and also a very good vehicle for illegally buying drugs. What more could a 15 year old who literally didn't have any other way of buying anything on the internet ask for? (That said, the only thing I ever bought with Bitcoin was a copy of Sonic Generations. That was not a good financial decision, in hindsight, as clearly HODLing was the better decision compared to using Bitcoin as a currency.)

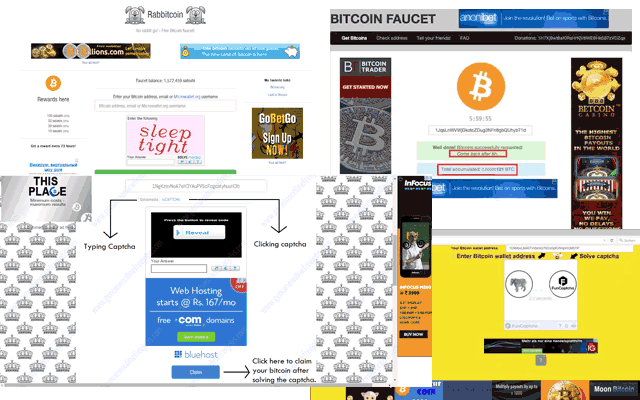

One popular service during early Bitcoin was "Bitcoin faucets", services that gave you small amounts of the currency (a few cents at best) in exchange for watching ads. I think the point was to get the currency in people's hands in order to stimulate the economy. As someone who simply didn't have the hardware to mine any reasonable amount at the time on my old laptop, this was perfect for bootstrapping my financial growth. And, because Bitcoin always goes up in value without fail, that actually worked out pretty well for the receiver so long as you were patient. Unfortunately, the price of Bitcoin is so high that it is completely pointless to run a faucet due to the fees, but they absolutely served their purpose in kickstarting the fledgling currency.

But I should re-iterate that Bitcoin was, at the time, completely unregulated, completely free from tyrannical government interference! Amazing! At that time, the most important Bitcoin exchange was Mt. Gox, which originally was the Magic the Gathering Online Exchange. During 2013 (according to this site), the price of a single Bitcoin shot up from about $10 to over $1000 at the year's high. (Had I seriously invested back then, I would be rich enough to retire by now. Unfortunately, I was 15... but you need to spend money to make money, so that's all fine in my book!) Mt. Gox was responsible for, at its peak, 70% of all worldwide BTC transactions.

Unfortunately, it was found they were embezzling money in 2014, abruptly shutting down the website. They had lost 7% of all Bitcoin in existence at the time, and a large percentage of that still has not been recovered. But, you know, that's just part of the game in the free market. You need to diversify your portfolio, hedge your bets, prevent risk. Anyone who lost a significant amount of money in there was clearly not savvy enough in the market. Obviously. And you really need to keep up with your due diligence too. Similar although less catastrophic incidents have occurred more recently with Bitfinex, which ended up replacing Mt. Gox as the preferred exchange for a while. There are countless exchanges and mining pools and such that have shut down, and due to the lack of regulation, there's not much that can be done about that. But that's just how the free market works. I don't need no stinking commie FDIC in the way of my investments. The invisible hand of the free market guides is all.

Let's not forget the free market opened up endless possibilities for new businesses. Those Bitcoin faucets showed advertisements for wonderful services such as online casinos, shops for drugs, and so on and so forth. Even online wallets (a requirement as the Bitcoin blockchain became too large to store on an average computer) joined in the fun. As an example, Blockchain.com is now fairly respected online wallet but at the time was a cobbled together Bootstrap web app. At one point had a button to spend your Bitcoin on a gambling game called "Satoshi Dice" without even leaving the site. You sent it some Bitcoin and it either increased it by some percentage or took it all. It listed odds and payouts, but still, there's nothing quite as exhilarating as being able to gamble everything away straight from your wallet. (I actually did that once, using I think the 97.5% odds option. That was a heart-pounding 15 minutes for sure.) Now that I think about it, that would also be super useful as a way to obfuscate where your coins came from, which is useful when buying from unregulated suppliers. I am super duper glad that all of these wonderful, useful, legitimate startups and casinos could flourish using the power of Bitcoin to truly make the world a better place.

As I got deeper into the Bitcoin world, I got wind of this thing called "Dogecoin". I brushed it off as a fad, even though a friend I had in high school was pushing me otherwise. But, over the next few months in 2014, it started to grow on me. One of the great strengths of Dogecoin was that it was so completely useless that people threw around Dogecoin in Reddit comments using the "dogetipbot". This was a great and wonderful way to get more and more people on board the Dogecoin hype rocket and blast off too the moon. In fact, by May 2014 the hype rocket was so strong that the community actually managed to fund a NASCAR car! The "Dogemobile", driven by Josh Wise, was the first great real world achievement the cryptocurrency community ever partook in. I tuned in to the livestream (or at least an unofficial livestream, as that was the only way to view NASCAR from your computer at the time) and was completely astonished by seeing that silly little Doge on a real NASCAR vehicle. Nowdays, Dogecoin is trumped up by absolute based legends like our lord and savior Elon Musk, and the price is shooting up and beyond to the moon!

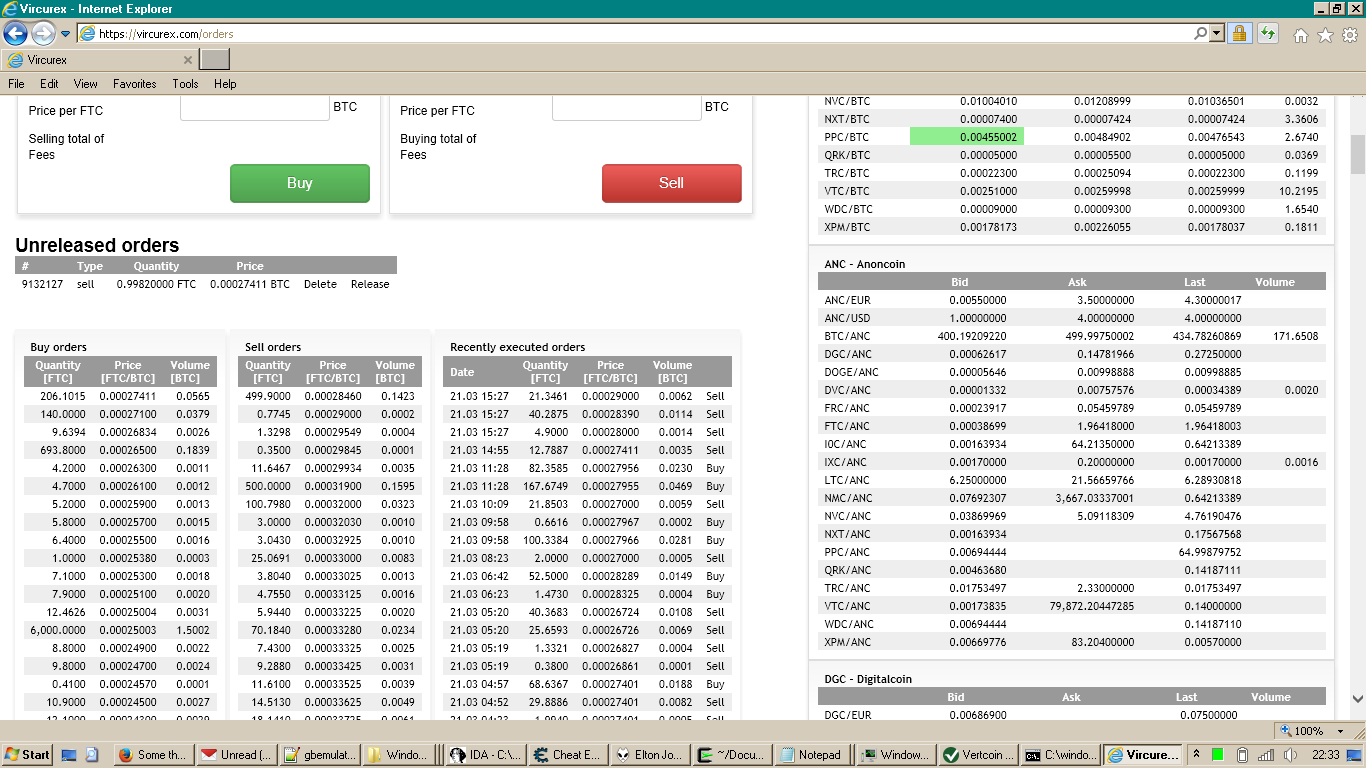

I seem to have used it on various crypto exchanges to try and day trade. This was actually quite an educational experience, watching all the graphs and charts to try and buy low and sell high. It certainly felt safer doing it with crypto than with fiat currency. Unfortunately, I failed to do my due diligence and lost all of it to fees. It wasn't that much though, so I'm not sad about it, and it taught me a valuable lesson in how to trade currencies on the market: don't!

But the Dogecoin and the day trading stuff was ultimately a fun distraction for me. The "altcoin" I was really starting to focus on was a now obscure thing called Vertcoin. See, there was an issue here. Bitcoin was originally meant to be mined on CPUs, and then GPUs. But as the network got more and more complex and secure, you needed more and more processing power to compete. There were also these new things coming out called ASICs, essentially dedicated silicon that's super efficient at the task of hashing. These often came from companies such as Antminer and the like. But these units were completely unaffordable, and besides, it was rumored that the manufacturers were using the cards until they were nearly dead before they were even shipped out! Clearly there needed to be some competition, as this monopoly on mining power could not stand, and the free market is quite famous for never converging upon monopolies. I should know, I read about it in Atlas Shrugged, the greatest book of all time.

Vertcoin was designed to be a completely ASIC-resistant coin. It used a very memory intensive and difficult hashing algorithm to secure the network, that had parameters tweaked every time there was even a hint of an effective ASIC in the pipeline. (Although, as an aside, it is quite strange that there's never a limit to how much processing power you can throw at it.) This, in my star struck eyes, was the solution to the ASIC problem. And it did sort of kind of take off. Well, not Vertcoin, anyways. What took off a lot more was a related project, Monero. This took the ASIC resistance of Vertcoin but also added the power of an obfuscated public ledger, meaning that all coins were completely untraceable. Perfect, for buying drugs off of the Silk Road. ...which was seized by those commies at the FBI. Dang you for not letting the market play out. Selling highly addictive drugs on the internet is a perfectly valid business, and if people don't like it, they'll just boycott it. Boycotts are super duper effective, and undeniably the best way to get a company to listen to you.) But regardless of that, by playing my cards just right I managed to profit big off of the Vertcoin community while it was thriving. And it was glorious.

I think Bitcoin is the greatest invention mankind has ever created. I hope that all transactions take place on cryptocurrency networks one day. Sure, it'll require a lot of power and a lot of warehouses of rare graphics cards to upkeep the network, but there is no other alternative to free market capitalism. As an objectivist, I believe that every person has the moral obligation to pull themselves up by their bootstraps, do their research, keep themselves clean, invest in the right markets, and mke big by making the world a more productive place. Anyone who says otherwise is nothing more than a lazy freeloader who simply isn't working hard enough. Us enlightened crypto investors are the fittest, and we shall survive when fiat currency falls in a decade or two or ten.

And now there's a lot of really exciting things happening in the crypto world. I tuned out for a bit and just HODL'd my existing investment, but these new NFTs look great. Owning a thing on the internet! Doesn't everyone want to do that? ........

Okay, fine, I can't type this crap anymore. This is an April Fool's bit. The whole thing is dripping with a deep layer of sarcasm with some truthful history in it. Yes, I had a libertarian cryptocurrency phase around 2013-2014, but I was never an objectivist or really this comically detached from the truth. A future article will touch more upon the faults of the crypto world, because yeah, I have just a little more Bitcoin stuff I need to get off my chest. This article here was originally intended to be a critical take on my past, but I couldn't pass up the urge to flanderize past me and poke fun at the entire crypto community.

And just to get your views of me back in tune: Cryptocurrency is one of the most ecologically destructive inventions mankind has created next to leaded gasoline and CFCs. Every person alive is trying their hardest and deserves a dignified life of food and shelter, unconditionally. Mutual aid and building strong, cohesive communities is a much better path to success than constant competition. And NFTs are the worst idea I've ever heard. Did you read my previous article?

Happy April 1st or whatever day you're reading this. Have a good one. And read my about page for more bad jokes.